Finding the right mix between passive and active investing can unlock both stability and growth. By understanding each approach and learning how to blend them, investors can pursue performance while controlling risk and costs.

Active investing demands hands-on management and tactical asset allocation. Investors or portfolio managers analyze market trends, company fundamentals, and breaking news to attempt market timing and stock selection. This approach can capture short-term opportunities but requires skill and constant attention.

By contrast, passive investing relies on a buy-and-hold mentality with minimal trading. It tracks indices using index funds or ETFs, aiming to match market returns rather than beat them. This method reduces fees, avoids emotional trading impulses, and benefits from the market’s natural growth over time.

Each strategy brings strengths and trade-offs. Comparing them side by side helps clarify how they might fit into your portfolio.

Lower costs with minimal fees

Broad market diversification

Reduced emotional trading impulses

Flexibility to seize market opportunities

Potential for outperforming indexes

Advanced risk management capabilities

Passive portfolios often outperform active funds over the long term once fees are deducted. Active strategies carry higher management and transaction costs but can generate outsized gains when markets are inefficient or volatile. Moreover, active management requires extensive market knowledge and ongoing commitment, which may not suit all investors.

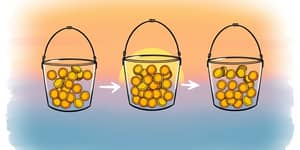

Over the past decade, assets under management in passive funds have surged, reflecting a widespread belief in market efficiency and cost-conscious investing. Studies show that more than 80% of active managers underperform their benchmarks over ten-year spans once fees are considered.

Yet during periods of market stress or rapid shifts, active strategies often see renewed inflows as investors seek tactical maneuvering. Emerging markets, niche sectors, and small-cap stocks may harbor inefficiencies that skilled managers can exploit. As a result, the industry continues to innovate with hybrid products like smart beta and factor-based ETFs.

One of the most popular frameworks is the core-satellite approach. In this model, the portfolio’s core consists of low-cost passive holdings that provide stability and broad exposure. Satellite positions employ active strategies to pursue alpha in targeted areas.

This structure offers a disciplined foundation while allowing flexibility to capture higher returns in specific segments.

Emotions can sabotage even the best-laid plans. Passive investing helps mitigate panic selling and giddy buying by enforcing a systematic, rules-based approach. Conversely, active strategies can trigger overconfidence or fear-driven decisions if not managed carefully.

By combining both, investors gain an anchor against emotional extremes. The passive core cushions against market shocks, while tactical satellite moves satisfy the desire to adjust during key cycles without jeopardizing long-term goals.

Tax efficiency is a compelling benefit of passive strategies: fewer trades mean fewer taxable events and simpler record-keeping. Active managers, however, may operate in tax-advantaged accounts or use loss harvesting to offset gains.

Expense ratios tell a clear story: passive funds often charge 0.04–0.15%, while active alternatives regularly exceed 0.70–1.00%. Looking ahead, technology and data analytics are reshaping active management, bringing sophisticated tools to individual investors and pushing costs downward.

Putting theory into practice requires clear steps. Define objectives, assess your tolerance, and decide on a target blend that aligns with your needs.

Adopting a long-term buy-and-hold mindset ensures that market noise doesn’t derail your strategy. Regular reviews help maintain alignment with evolving goals and changing market conditions.

Balancing passive and active strategies offers the best of two worlds: the cost efficiency and stability of index tracking, plus the opportunity for outperformance through targeted, empowered decision-making. Investors who embrace this synergy can build resilient portfolios designed for uncertain markets and shifting opportunities.

Your journey begins by evaluating where you stand today and envisioning where you want to be tomorrow. Armed with knowledge, a clear plan, and the right blend of strategies, you can navigate volatility, harness growth, and confidently pursue your financial aspirations.

References