Your financial journey is intertwined with every major milestone—from marriage and career changes to retirement and caregiving.

By acknowledging how personal transitions reshape priorities and risk tolerance, you can build a resilient portfolio that adapts automatically over time.

In this article, we'll explore the psychological and social forces at play, examine data-backed strategies for age-based allocation, and share actionable insights for every life stage. By weaving together research from sociology, psychology, and finance, you'll emerge with a clear roadmap for aligning your investments with your evolving life story.

Life transitions represent significant changes in family, social, economic or personal circumstances that impact routines, responsibilities, and resources. Events such as marriage, divorce, career shifts, bereavement, or becoming a caregiver can disrupt daily habits and challenge financial equilibrium.

Over the past decades, social patterns have evolved dramatically. By 1999, dual-income households comprised 53% of married families, up from just 40% in the 1970s, while women’s labor participation rose to 57% of the civilian workforce. Many adults now find themselves in the “sandwich generation,” managing both children and aging parents simultaneously.

These shifts can give rise to daily routines which can challenge psychological wellbeing, triggering stress, anxiety, or hesitation when making long-term financial decisions without a clear framework.

Coping with transitions requires emotional resilience supported by clear routines and social networks. Research shows that individuals with strong support systems and defined coping strategies navigate financial turbulence more effectively, minimizing impulsive or fear-driven reallocations.

Meta-analytic studies reveal that events like marriage, divorce, or the transition into one’s first job produce measurable changes in life satisfaction and character traits such as conscientiousness and emotional stability (effect sizes up to d=0.337). While individual shifts may be small, small personality shifts compound over time, subtly influencing spending, saving, and investment choices.

Graduation, career promotions, relocations, or serious health events also leave their imprint, often redefining priorities and risk appetite in ways that may not be immediately obvious.

For example, a newly married couple might increase equity exposure to capitalize on a longer investment horizon, while a divorced investor may prioritize liquidity to fund legal fees or settle asset divisions. Recognizing these nuances prevents one-size-fits-all solutions and fosters tailored decision-making at every turn.

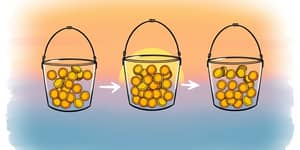

Asset allocation is a living strategy, not a static plan. It adjusts to your current goals, risk tolerance, and time horizon. By establishing asset allocation is not one-size-fits-all, you acknowledge the need for bespoke portfolios that react to each new chapter of life.

Key trigger points for portfolio reallocation include:

Regular check-ins—at least annually or when any of these events occur—ensure your investments remain aligned with evolving needs and ambitions. Regularly scheduled reviews drive long-term success and prevent reactive decisions driven by short-term emotions.

Moreover, cultural norms, tax considerations, and geographic factors can influence which events matter most. In regions with high inheritance taxes, planning for legacy distribution may prompt earlier shifts toward tax-efficient bonds or municipal securities.

The following table outlines a general framework for adjusting your portfolio based on life stage, typical events, and recommended allocation.

While these percentages serve as a general benchmark, your personal timeline might diverge. A second-career entrepreneur in their 40s, for instance, may choose a more aggressive equity tilt, while another individual may favor bonds to protect capital amid uncertain health prospects.

Maintaining a balance between growth and stability becomes increasingly important as life priorities shift towards protection and predictable income.

By following these steps, you transform reallocation from a reactive chore into a strategic habit that safeguards your financial future.

Remember that diversification extends beyond asset classes—consider alternative investments, real estate, and cash equivalents to cushion against market downturns and match near-term liabilities.

Transitions often trigger emotional decision-making during critical transitions such as panic selling or impulsive risk-taking. Establishing predetermined rules for rebalancing and withdrawals can curb these tendencies and promote rational choices.

Developing a written allocation policy statement can serve as an anchor during volatile markets, minimizing the risk of making emotionally charged alterations that deviate from your long-term plan.

Awareness of social and demographic trends influence timing—like rising dual-income households, extended working years, and evolving family structures—helps anticipate when you may need to revisit your strategy.

Life is inherently dynamic, and your financial plan should be equally adaptable. By factoring in marriage, children, career shifts, health events, and retirement, you equip yourself with a portfolio that anticipates change rather than reacts.

Ultimately, the goal is to cultivate a mindset that views reallocations as opportunities rather than obstacles. Each recalibration can bring you closer to financial freedom, personal aspirations, and the legacy you wish to leave.

By embedding flexibility into your financial strategy, you transform external shocks into moments of strategic refinement. Your portfolio becomes a living reflection of your life’s journey, responsive to hope, challenges, and growth.

References