In an era of shifting economies, protecting purchasing power is more crucial than ever. By weaving inflation hedges into your portfolio, you build resilience and confidence.

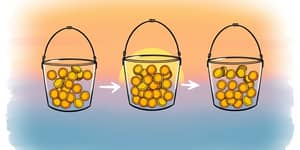

Inflation hedge refers to an investment designed to guard against the declining purchasing power of money when prices rise. As inflation eats into nominal returns, the real value of portfolios can erode if unprotected.

The core objective is to offset the impact of inflation on portfolio returns, ensuring that wealth grows in real terms. Over time, strategic hedges preserve purchasing power, safeguarding future goals such as retirement funding, education, or major purchases.

Periods of geopolitical turmoil, supply chain disruption, or aggressive monetary policies often coincide with inflationary spikes. Even a seemingly healthy portfolio yield of 5 percent can result in a net loss of purchasing power if inflation jumps to 6 percent.

Institutional and individual investors alike recognize that when currencies depreciate or interest rates climb, traditional bonds and cash holdings can underperform. By incorporating inflation-hedged assets, investors mitigate downside real risk and maintain portfolio stability.

Different asset classes offer varied inflation protection, each with unique mechanisms and trade-offs. Understanding these nuances helps craft a balanced strategy.

Reviewing past inflationary periods illuminates how different hedges behaved when prices surged. Gold, for example, surged ahead when inflation topped 3 percent, while TIPS faithfully tracked consumer prices.

Real estate and REITs provided stable rental income growth, offsetting inflationary pressures on consumer budgets. Equities in essential sectors demonstrated resilience, though high-input industries sometimes lagged.

By examining historical data, investors gain valuable context for future decisions, recognizing that no single asset perfectly shields every scenario. Blended approaches often yield smoother risk-adjusted outcomes.

Constructing an inflation-resistant portfolio involves thoughtful design, regular monitoring, and periodic rebalancing. Consider these practical steps:

Regularly rebalance to maintain target allocations, especially after market moves. This discipline ensures that hedges remain effective rather than drifting into unintended risk exposures.

While inflation-hedged assets offer protection, they carry inherent risks. TIPS can underperform when real yields climb, and gold may lag in low-inflation periods.

Commodities faces supply chain or geopolitical disruptions that can cause extreme volatility. Real estate investments can suffer from local market downturns and liquidity constraints, and alternative assets may present valuation challenges.

Understanding the nature of inflation—whether driven by demand-pull pressures or cost-push shocks—helps tailor hedges. Geographic factors also influence effectiveness; emerging markets may require different approaches than developed economies.

In uncertain economic landscapes, inflation-hedged assets are essential tools for preserving real wealth. By blending a variety of hedges—including TIPS, real assets, and selected equities—you build a resilient portfolio capable of weathering price surges.

Thoughtful implementation, ongoing monitoring, and regular rebalancing are critical to maintain the protective qualities of these assets. With a balanced strategy, you can face rising prices with confidence, knowing your portfolio is positioned to sustain and grow real purchasing power for the long term.

References