In today’s complex financial landscape, every percentage point matters. Investors seeking to optimize their portfolios must pay close attention to hidden expenses that quietly erode gains.

By understanding and managing expense ratios, you can safeguard growth, enhance long-term performance, and build confidence in your financial journey.

Expense ratios, also known as cost ratios, measure the annual fees charged by funds relative to their assets under management. These fees cover management, administration, marketing, and distribution costs. Expressed as a percentage, they represent the proportion of your investment consumed each year.

The formula is straightforward: Total Fund Costs divided by Total Fund Assets equals the expense ratio. Yet the impact on your portfolio can be profound, especially over decades of compounding.

Expense ratios come in several forms:

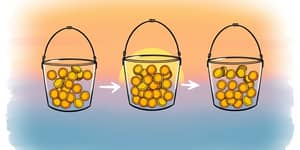

Even small differences in expense ratios can create a significant drag on returns over time. A fund charging 0.10% compared to 1.00% may seem trivial, but compounded over 30 years, the difference can be thousands of dollars.

Consider an investment of $10,000 growing at 7% annually. After 30 years, the lower-cost fund yields markedly higher results:

This compounding effect of fees highlights why controlling costs is not merely a tactical choice, but a strategic imperative for long-term investors.

Different types of funds carry varying fee structures. Passive index funds typically boast the lowest expense ratios, while actively managed funds charge more to cover research and trading activities. Understanding these distinctions helps you align costs with investment objectives.

As competition intensifies, expense ratios have trended downward. Technological advances and investor demand for low-cost options have pushed many fund managers to reduce fees, benefiting shareholders.

Awareness is the first step to control. Regularly review fund prospectuses and financial statements to verify current expense ratios. Prospective changes, such as fee waivers expiring, can increase your cost burden unexpectedly.

By monitoring cost ratios regularly, you ensure alignment with your investment strategy and avoid unpleasant surprises. Set a schedule—quarterly or semi-annually—to audit your holdings and compare fees across similar funds.

Consider these strategies to minimize drag on returns:

Finding expense ratios is easier than ever. Visit fund websites, download prospectuses, or use financial aggregator platforms. Look for the net expense ratio in the summary section; this is your out-of-pocket cost.

To calculate your actual annual fees, multiply the net expense ratio by your portfolio balance. For example, a 0.75% ratio on a $20,000 position equals $150 per year. Understanding the dollar impact provides clear perspective on trade-offs and fund selection.

Be aware of temporary fee waivers that funds sometimes advertise. While they reduce costs in the short term, waivers can expire, causing ratios to spike. Reviewing the prospectus’ fee waiver section helps you anticipate future changes.

Expense ratios may seem small, but their cumulative impact can be substantial over the long haul. By understanding, comparing, and monitoring cost ratios, you position your portfolio for stronger, more resilient performance.

Embrace a proactive approach: commit to regular fee reviews, choose low-cost funds aligned with your goals, and never underestimate the power of minimizing hidden fees. This disciplined focus will translate into more capital compounding for your future.