Building a resilient financial future requires more than simply picking the right investments—it demands a thoughtful approach to where those investments are held. Maximize after-tax returns through smart allocation by understanding and leveraging the benefits of tax-advantaged accounts. In this article, we explore the definitions, rules, and strategies that will help you shelter growth, minimize tax drag, and accelerate your long-term wealth building.

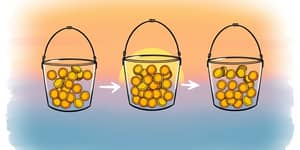

Tax-advantaged accounts are specialized savings vehicles that provide tax breaks at different points in time. They can reduce your taxable income when you contribute, grow assets tax-deferred or tax-free, or allow tax-free withdrawals for qualified expenses. By selecting the right account type for each asset, you can tilt the odds in your favor and preserve more of your returns.

There are three broad categories of tax-advantaged accounts, each with distinct rules and benefits:

Examples of tax-deferred accounts include Traditional 401(k), Traditional IRA, and SEP IRA. Roth IRA and Roth 401(k) represent the tax-exempt bucket, while Health Savings Accounts (HSAs), Flexible Savings Accounts (FSAs), 529 college savings plans, and Coverdell ESAs fall into the specialized category.

Staying within IRS limits is critical to avoid penalties and maximize benefits. Below is an overview of 2024–2025 contribution caps and income thresholds:

Note: Always verify for updated IRS figures before making contributions.

Traditional (tax-deferred) accounts reduce taxable income today, with taxes paid at withdrawal—potentially at a lower rate in retirement. Roth (tax-exempt) accounts demand after-tax contributions but deliver tax-free growth and withdrawals, ideal if you anticipate a higher future tax bracket. HSAs offer triple tax benefits of HSAs: deductible contributions, tax-free growth, and tax-free qualified medical withdrawals. Understanding these nuances allows you to forecast your tax liabilities and choose the optimal combination for your situation.

Employer-sponsored plans like 401(k) and 403(b) can include matching contributions—effectively “free money.” Always aim to capture the full match before investing elsewhere. Employer matches amplify your total savings rate and should shape your primary allocation decisions.

HSAs can serve as a supplemental retirement account after covering health costs, given their unique tax structure. 529 plans grow tax-deferred, and qualified withdrawals for education are tax-free. Coverdell ESAs offer flexibility for K–12 expenses. Allocating resources to these accounts can reduce future education and healthcare costs, freeing up taxable assets for other goals.

Once you determine your target mix of stocks, bonds, and real estate, decide where each should reside:

Smart asset location enhances long-term compounding and minimizes drag from dividends, interest, and capital gains taxes.

Follow a disciplined sequence to ensure you’re maximizing every available benefit:

Every account carries rules and potential pitfalls. Key considerations include:

Tax policies evolve, and your income trajectory may shift. Revisit your allocation annually to account for new legislation or changes in your financial picture. Roth accounts hedge against rising future rates, while traditional vehicles can be beneficial if you expect a significantly lower bracket in retirement. A dynamic strategy keeps you agile and prepared for uncertainty.

References