Constructing a resilient investment portfolio hinges on understanding how its components interact under varying market conditions. Monitoring the relationships between assets allows investors to harness true diversification benefits and maintain an optimal risk profile. In this detailed guide, we explore why correlation matters, how to review it, and practical strategies to manage portfolio risk effectively.

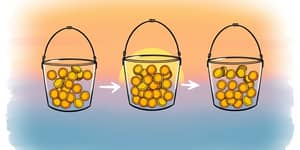

Correlation measures the degree to which two asset prices move in relation to one another, typically ranging from –1 (perfect negative correlation) to +1 (perfect positive correlation). A zero correlation indicates no relationship. By combining assets with low or negative correlations, investors can achieve significant reduction in portfolio risk without sacrificing expected returns.

However, not all diversification is equal. Holding multiple assets within the same sector or class may offer little cushion if their correlations remain high. True risk mitigation arises when asset returns offset each other during market swings, smoothing overall portfolio volatility.

Asset correlations are not static. During periods of market stress—such as economic downturns, geopolitical events, or sudden liquidity crises—historical relationships may shift dramatically. Equities and bonds, which often move independently or negatively under normal conditions, can become positively correlated in extreme sell-offs.

Industry experts recommend a dynamic or periodic review of correlation metrics to ensure portfolios adapt to evolving market regimes. While quarterly or semi-annual assessments suffice for many investors, those navigating highly volatile environments may choose more frequent checks.

Interpreting results requires attention to extreme values. High positive correlations hint at concentration risk, while strong negative readings may reveal diversification opportunities. Investors can then rebalance or introduce new assets to optimize their mix.

Adopting a proactive portfolio management approach helps investors respond swiftly when key correlations deviate from expectations, preserving capital and capturing opportunities.

Historical episodes underscore the value of correlation monitoring. During the 2008–2009 financial crisis, US equities and Treasuries displayed a marked negative correlation, cushioning balanced portfolios against severe equity drawdowns. A similar pattern emerged in 2020, as pandemic-induced volatility sent investors flocking to high-quality bonds.

Research spanning 1990–2018 demonstrates that two-factor portfolios using low-correlation asset pairs often outperformed the broad stock market during periods of extreme dislocation, though benefits can reverse when markets normalize and correlations revert.

These figures highlight how correlations can swing sharply, affirming the need for continuous and disciplined monitoring.

Effective correlation oversight blends technology and process. Many institutional investors employ automation tools to refresh correlation matrices and issue alerts when thresholds are breached. Documenting review schedules and decision criteria in an investment policy statement ensures transparency and consistency.

Despite its utility, correlation analysis has limitations. Overreliance on historical data may mislead, as past relationships can break down under new economic regimes. Moreover, correlation measures relationships but does not establish causation. Investors should interpret results within the broader context of macroeconomic trends and market structure.

Regularly reviewing portfolio correlations is not merely a procedural task—it is a cornerstone of resilient investing. By embedding correlation analysis into routine risk and performance reviews, investors can maintain portfolios aligned with their objectives, even as market dynamics shift.

Ultimately, the goal is to craft a portfolio that weathers storms and captures upside, striking an enduring balance between risk and reward. Embrace correlation review as an ongoing endeavor, and let data-driven insights guide your path to long-term success.

References