In an environment where emotions and instinct often outweigh logic, systematic patterns of deviation from rationality can derail even the most careful plans. Behavioral biases are deeply rooted tendencies that influence our choices, frequently leading to impulsive or regretful decisions. By introducing intentional guardrails, individuals and organizations can steer choices toward clearer, data-driven outcomes.

Behavioral biases are tendencies to make impulsive, trend-chasing decisions rather than rational, evidence-based choices. These biases arise from cognitive shortcuts, emotional pressures, or social influences, distorting perception and judgment.

In finance, for example, biases can cause investors to overtrade, cling to losing positions, or follow popular sentiment into market bubbles. Recognizing these patterns is the first step in designing interventions that reduce their power.

This table highlights just a few of the most common biases. Others, like confirmation bias or availability bias, further complicate decision-making by filtering information or overemphasizing recent events.

Human brains are wired to simplify complex reality through mental shortcuts, known as heuristics. While these shortcuts can be efficient, they also introduce distortions. For instance, when negative news dominates headlines, availability bias makes losses feel more likely than balanced statistics suggest. Similarly, endowment effect leads us to overvalue assets we already own, even when selling would improve our portfolio.

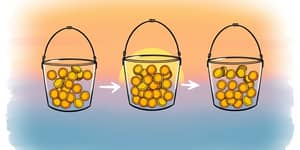

These distortions compound over time. An overconfident trader might ignore warning signs, incur repeated losses, and chalk up poor performance to bad luck rather than flawed judgment. Likewise, herd behavior in markets has caused some of history’s most dramatic crashes, illustrating how collective irrationality can amplify individual biases.

Establishing structured decision processes for investing helps override emotional impulses. By embedding clear checkpoints and review stages, decision-makers can slow down, weigh evidence, and adhere to predetermined standards rather than gut reactions.

These six strategies work in concert. For example, a financial firm might combine algorithmic alerts with human review panels, ensuring that technology and diverse expertise each play a role in maintaining disciplined choices.

During the 2008 financial crisis, many retail investors fell prey to availability bias. Traumatized by recent losses, they exited equity markets en masse, missing the subsequent long-term rally that delivered significant gains. A more disciplined approach—perhaps guided by predetermined re-entry rules—could have prevented these costly mistakes.

On the technology front, leading AI labs now require bias impact statements before deploying new models. These statements document potential sources of algorithmic prejudice and outline mitigation steps. When combined with routine data audits and stakeholder feedback sessions, this guardrail process has reduced unfair outcomes in hiring and lending platforms.

Behavioral biases may be unavoidable, but their influence is not immutable. By layering educational initiatives, formal processes, technological tools, and diverse oversight, organizations can build a resilient framework that channels decision-making toward more rational, evidence-based outcomes.

Success lies in the synergy of methods: awareness equips individuals to catch their own blind spots, structured procedures redirect actions into proven paths, and technology provides continuous monitoring and feedback loops. When combined, these guardrails form an integrated defense against the subtle forces that steer us off course.

Ultimately, fostering a culture that values self-reflection, disciplined review, and open dialogue will yield lasting improvements in performance and resilience. As biases evolve with changing environments, so too should our guardrails—ensuring that each choice aligns with long-term goals and sound judgment.

References