Retirement can bring excitement, freedom, and uncertainty. Crafting a plan that ensures a steady income while protecting your nest egg from market swings is essential. The bucket strategy offers a clear framework to meet near-term needs, buffer against volatility, and keep long-term growth on track.

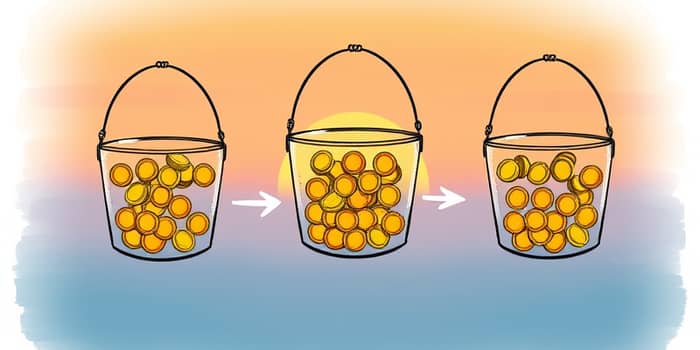

The bucket strategy, often called the "three-bucket approach," divides your portfolio into separate pools based on distinct time horizons and risk profiles. Each bucket serves a defined purpose: immediate spending, intermediate stability, and long-term growth. This structure allows retirees and pre-retirees to match assets with anticipated withdrawals and avoid selling growth investments in down markets.

By segregating assets, you create a clear roadmap for withdrawals. The strategy addresses the dreaded sequence of returns risk by ensuring that short-term needs are funded from safe assets, leaving growth assets untouched during market dips. Over time, disciplined transfers replenish the safety bucket from growth, enabling a buy low/sell high dynamic.

Market volatility can force panicked sales and erode portfolios. With the bucket approach, you tap the cash bucket in down years, preserving equity positions for recovery. This emotional discipline tool mitigates the lure of panic selling and helps you ride out market corrections.

Psychological comfort is a major upside. Knowing that immediate spending is funded by conservative assets delivers peace of mind. Instead of watching your entire portfolio fluctuate daily, you focus on a secure spending pool. Meanwhile, your growth bucket remains invested for long-term capital appreciation, outpacing inflation and supporting future withdrawals.

Allocations vary by personal needs, risk tolerance, and market outlook. A common guideline is:

As an example, if you need $60,000 annually, you might hold $60,000–$120,000 in Bucket 1, $180,000–$300,000 in Bucket 2, and assign the remainder to Bucket 3. Over time, when markets perform well, you transfer gains from Bucket 3 to refill Bucket 2, and from Bucket 2 into Bucket 1.

Putting the bucket plan into action requires a systematic process. Follow these core steps to build and maintain your buckets:

Markets evolve, as do personal circumstances. A quarterly or annual review helps you spot underfunded buckets, shifting market conditions, and changing goals. If inflation spikes, you may need to increase the cash bucket or adjust your withdrawal rate. Conversely, a bull market might allow you to trim risk in the growth bucket.

Professional advice can be useful for complex portfolios. However, many investors find that disciplined execution and a clear framework provide sufficient guidance. The key is to stay committed to the plan and avoid reactionary moves based on short-term noise.

This approach suits retirees or soon-to-be retirees who value stable income streams and worry about pulling funds from volatile assets during downturns. It also appeals to those seeking a balance between liquidity and growth, and who prefer a tangible spending plan rather than an abstract portfolio percentage.

If your portfolio is modest or your withdrawal needs vary dramatically year to year, you may need a more flexible variation. Younger investors might adapt the buckets concept for saving for major goals like education or home purchases.

The bucket strategy delivers a structured, risk-aware blueprint for planned withdrawals. By segregating assets by time horizon, you protect income from market turbulence and preserve long-term growth potential. Implementing this framework involves careful planning, disciplined rebalancing, and periodic adjustments.

With clear buckets in place, you gain the confidence to enjoy retirement, knowing that near-term spending is secured, intermediate needs are buffered, and long-term aspirations remain on track.

References