In the turbulent 2020s, fluctuations in commodity prices have posed unique challenges and opportunities for emerging economies. From the whipsaw of pandemic lows and wartime highs to the accelerating green energy transition, these cycles test resilience and adaptability at every turn.

This article explores the latest trends, sector dynamics, fiscal responses, and forward-looking strategies empowering emerging markets to thrive amid persistent volatility.

Commodity price movements have become more pronounced since 2020. After the steep downturn triggered by COVID-19, markets rebounded with unprecedented force following geopolitical upheavals, notably Russia’s invasion of Ukraine. Recent data reveal that average cycle durations, historically around four years since 1970, have halved, ushering in a new era of rapid boom-and-bust swings.

Key drivers include continued geopolitical tensions and supply shocks, accelerated demand from electric vehicle adoption, and climate-induced supply disruptions. The resulting volatility reverberates across energy, metals, and food markets, underscoring urgent adaptation imperatives.

Emerging economies are projected to grow at 3.7% in 2025—down from a decade-average of 4% but still roughly double the pace of advanced economies. However, persistent inflationary pressures, with forecasts showing an average of 5% inflation in 2025 (versus 2% targets), continue to strain budgets. Certain countries, such as Bolivia, Ghana, and Turkey, face double-digit inflationary environments, while China remains an outlier with flat, zero-percent inflation over two years.

Repeated commodity swings undermine fiscal stability. Governments must balance infrastructure investments and social spending against volatile revenue streams. Strengthening institutional frameworks and creating fiscal buffers are essential steps toward sustainable growth and enhanced economic resilience.

Different commodity sectors exhibit distinct trends and challenges. Understanding these nuances is critical for targeted policy responses and investment decisions.

Emerging economies are deploying multifaceted strategies to manage commodity volatility and secure long-term growth.

These measures, underpinned by credible central bank policies and robust domestic demand, help cushion external shocks and foster greater self-reliance.

Commodity cycles affect regions differently. In Asia and the Middle East, increasing export capacities, coupled with onshore renminbi trade finance, are bolstering trade flows. Meanwhile, Latin America and Africa benefit from sustained demand for critical minerals but must navigate price volatility and climate risks.

In Bolivia and Ghana, agricultural and mineral sectors are vital, yet double-digit inflation underscores the need for deeper fiscal reforms. Nigeria’s oil-dependent economy continues to seek balance between production incentives and budgetary constraints. China stands out for its low-inflation environment, offering a counterpoint to more turbulent markets.

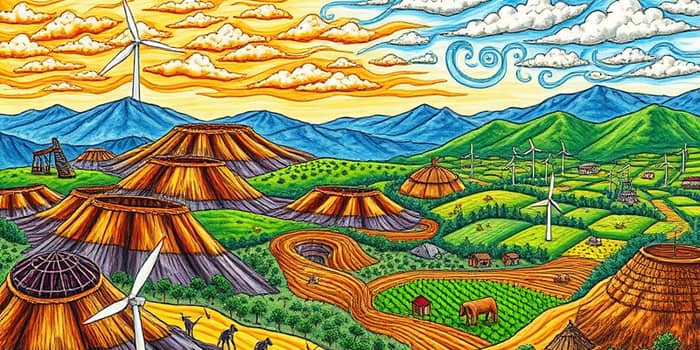

Agriculture and resource extraction significantly impact ecosystems and communities. Agriculture alone occupies half of the planet’s habitable land and accounts for one-quarter of global greenhouse gas emissions. Emerging markets face mounting pressure to adopt sustainable practices, reduce land-use footprints, and invest in cleaner technologies.

Addressing ESG issues is not only a moral imperative but also essential for maintaining investor confidence and unlocking green finance opportunities.

Volatile commodity cycles are likely to persist as geopolitical tensions, climate events, and technological shifts converge. Emerging markets must brace for a new normal of elevated price swings, necessitating agile policymaking and innovative financing solutions.

Deeper integration into global capital markets, supported by regulatory reforms, can expand access to long-term funding. Digitalization of trade finance and supply chain management offers significant efficiency gains and resilience benefits.

Investors eye the so-called “green premium,” channeling capital toward countries with critical mineral endowments and renewable energy projects. This trend presents emerging economies with a strategic opportunity to leverage their natural resources for sustainable development and inclusive growth.

By embracing diversification, fiscal prudence, institutional strengthening, and ESG best practices, emerging markets can transform commodity challenges into a platform for innovation and resilience. The journey ahead will be complex, but with informed strategies and global cooperation, these economies can chart a path to prosperity amid an ever-shifting commodity landscape.

References