In early 2025, sweeping changes in global trade regulations have sent ripples through manufacturing sectors worldwide. Businesses large and small are grappling with heightened cost pressures and strategic uncertainty as new tariffs and policy measures come into effect. This article examines how these shifts are reshaping manufacturing orders, impacting supply chains, and driving companies to adapt with agility and resilience.

Beginning in March 2025, the U.S. government enacted a series of aggressive tariff increases and revisions. Policies targeted major partners such as China, Canada, and Mexico, raising duties on critical inputs and finished goods.

Key actions included:

These measures represent a dramatic escalation and revision in trade policies aimed at recalibrating the balance of imports and revitalizing domestic production.

An overview of the most impactful policy changes highlights the pace and scale of intervention.

Facing sudden cost increases, many companies have adjusted order schedules and sourcing strategies to mitigate risk.

Common responses include:

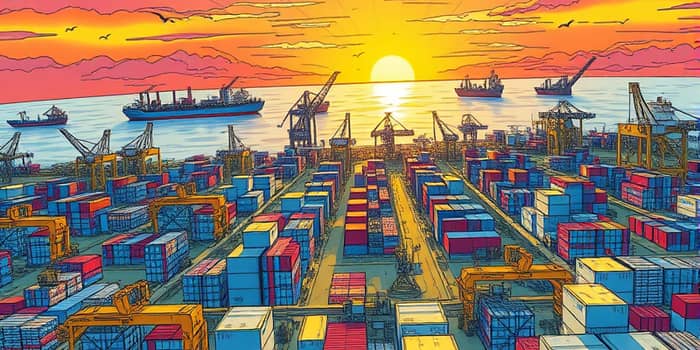

These approaches have led to volatile order volumes and logistics bottlenecks, especially at major ports and inland freight hubs.

The impact of these policy changes varies significantly across industries.

Across these sectors, companies are reevaluating supply chain footprints, weighing the benefits of nearshoring versus the costs of transition.

To survive in this uncertain environment, firms are deploying a range of adaptation strategies.

As these measures take hold, some manufacturers are reporting notable gains in operational resilience, while others struggle with the upfront investment required.

Looking ahead, trade policy is likely to remain a central lever of both economic and geopolitical strategy. Anticipated trends include:

1. Increased domestic content mandates in strategic sectors such as defense and renewable energy.

2. Further tariff negotiations and temporary rollbacks tied to diplomatic milestones.

3. Rising emphasis on circular economy principles and sustainable sourcing practices.

To navigate this evolving landscape, industry leaders recommend:

1. Building policy intelligence capabilities: Continuously monitoring regulatory developments and preparing rapid response plans.

2. Investing in flexible manufacturing systems: Modular production lines that can switch inputs or outputs based on cost dynamics.

3. Strengthening public-private partnerships: Collaborating with government agencies to shape fair and transparent trade frameworks.

By combining foresight with tactical agility, manufacturers can not only weather the current storms but emerge stronger and more competitive on the global stage.

In conclusion, the 2025 wave of trade policy shifts represents both a challenge and an opportunity. Companies willing to embrace strategic adaptation and resilience will be best positioned to convert volatility into lasting advantage, ensuring sustained growth in an unpredictable world.

References